Tags

Baton Rouge Real Estate, Home Ownership Tax Benefits, Housing Market Trend, Relavent Real Estate News

Future Market Thoughts

If you’re planning to buy a home, one thing to consider is what experts project home prices will do in the future and how that might affect your investment. While you may have seen negative news over the past year about home prices, they’re doing far better than expected and are rising across the country. And data shows, experts forecast home prices will keep appreciating.

Experts Project Ongoing Appreciation

Pulsenomics polled over 100 economists, investment strategists, and housing market analysts in the latest quarterly Home Price Expectation Survey (HPES). The results show what the panelists project will happen with home prices over the next five years. Here are those expert forecasts saying home prices will go up every year through 2027 (see graph below):If you’re someone who was worried home prices would fall because of stories you’ve read online, here’s the big takeaway. Even though home prices vary by local market, experts project prices will continue to rise across the country for years to come. And these numbers indicate the return to more normal home price appreciation.

And while the projected increase in 2024 isn’t as large as 2023, it’s important to recognize home price appreciation is cumulative. In other words, if these experts are correct, after your home’s value rises by 3.32% this year, it’ll appreciate by another 2.17% next year. This is a good example of why owning a home is a choice that wins big over time.

What Does This Mean for You?

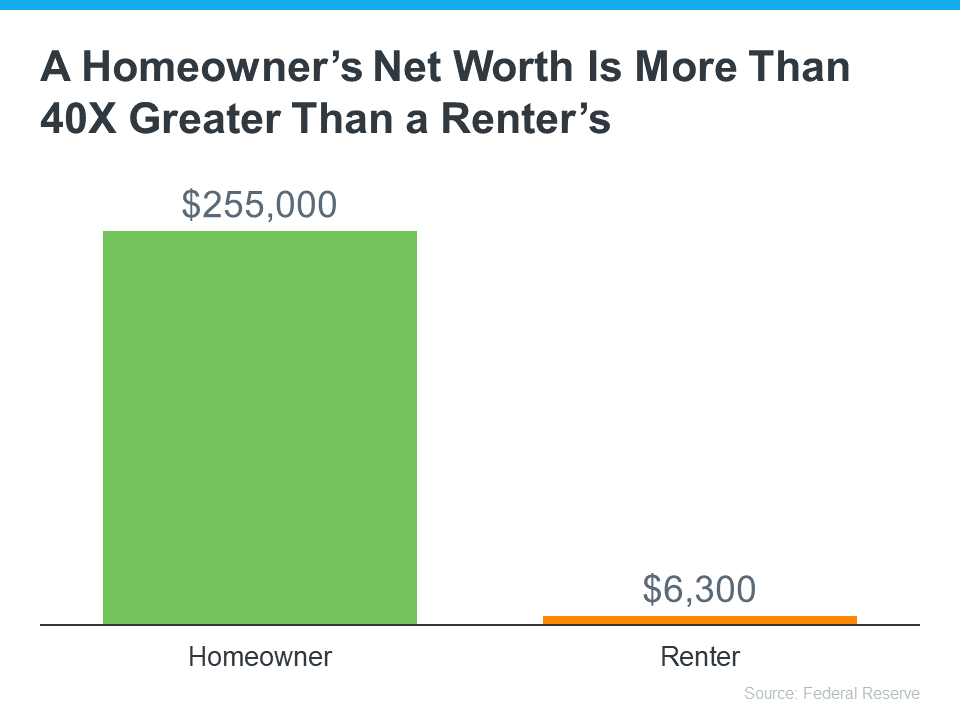

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth. To see how a typical home’s value could change in the next few years using the expert projections from the HPES, check out the graph below:In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

So, if you’re thinking about whether buying a home is a good choice, remember how it can be a powerful way to grow your wealth in the long run.

Bottom Line

According to the experts, home prices are expected to grow over the next five years at a more normal pace. If you’re ready to become a homeowner, know that buying today can set you up for long-term success as home values (and your own net worth) grow. Let’s connect to start the home buying process today.