Tags

Baton Rouge Real Estate, Baton Rouge Real Estate Trends, first time home buyers, home financing, home ownership, Home Ownership Tax Benefits, home prices, Housing Market Trend, mortgage rates, Mortgages, News you can USE!, Real Estate, Relavent Real Estate News, rising home prices, rising mortgage rates, today's market

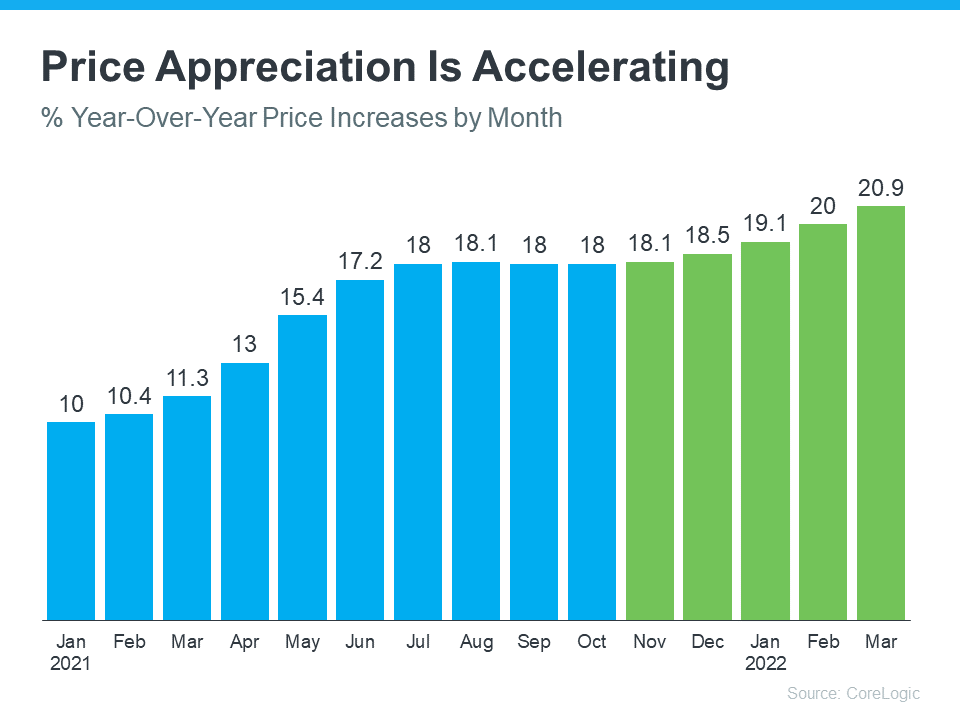

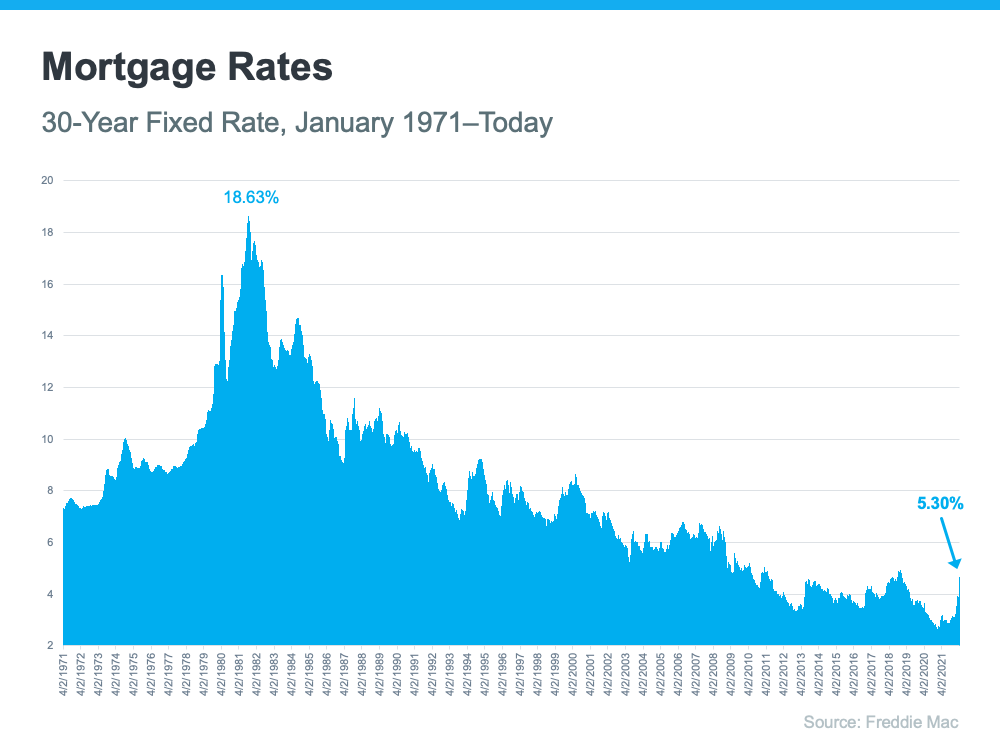

If you’re looking to buy your first home, you’re likely balancing several factors. Because both mortgage rates and home prices have risen this year, it costs more to buy a home than it did even just a few months ago. But that doesn’t mean you have to put your plans on hold.

If you partner with a trusted real estate advisor and hone your strategy, you can navigate today’s market and find the home you’re looking for. Here are two tips to help you get started.

Work with a Professional To Prioritize Your Wish List

If you’re having trouble finding a home in your budget that checks all the boxes, it may be worth taking another look at your lists of what you want and what you really need. According to the latest First-Time Homebuyer Metro Affordability Report from NerdWallet, your wish list can have as much impact on your search as your finances:

“Your budget isn’t all that you need to be concerned about; your wish list and desired location may carry just as much weight.”

It’s all about prioritization. If you’re serious about purchasing your first home soon, be flexible in what you’re looking for to open up your pool of options. Partner with a local real estate professional to better understand what’s available in today’s market and reprioritize your wish list. Remember, making a concession now doesn’t mean you’ll never have everything on your list. After you’ve moved in, you can always add certain features to make the home your own.

Increase Your Search Radius To Consider More Locations

Some areas may have more homes within your target price range than others, but it may require you to be flexible on your location. For example, if you’re a remote worker, you may be able to expand your search radius. As Fannie Mae explains:

“. . . continued remote work flexibility is likely giving many the ability to live farther away in more affordable areas.”

The decision to search in places with a lower cost of living could help you find a home that fits your budget and checks the most boxes off your wish list.

Bottom Line

If you’re serious about purchasing your first home this year, revisiting your wish list and desired location can help. Let’s connect to explore all the options in our local market – and beyond – so you can achieve your homeownership dreams.